question 3 of 10 choose the best scenario for refinancing

Essay Help for Your Convenience. F9 Financial Management Question Bank.

Get all these features for 6577 FREE.

. RFID blocking wallets and bags that claim to block RFID signals typically use what is called a Faraday cage named after scientist Michael Faraday. 1091 The best writer. Full PDF Package Download Full PDF Package.

The Discounts on Black Friday and Cyber Monday Were Worse This Year. Which is the best option that can exists. There are two different pieces to this.

Related

Whether they actually work is the question worth asking. In fact it is mostly limited to refinances on owner-occupied properties onlyPurchase transactions do not have a rescission period. Learn all about the best student loan refinancing companies of 2021 and read the latest CARES Act info.

However client education involves a certain amount of risk because whatever information the broker or salesperson in. Most refinancing lenders offer loan repayment terms of 10 15 and 20 years. More details 30-year fixed is the most common mortgage type.

Though much is still unknown about the new omicron variant of COVID-19 vaccinations remain Louisianas best defense at preventing another deadly surge in. Galaxy Digital Holdings and Voyager Digital both fell by 12 and 10 respectively in early Monday morning trading. Income must be below a certain threshold 115 of the average area median.

Closing costs for refinancing can be very expensiveanywhere between three and six percent of the remaining principle on your loan. Receive your papers on time. This means that if you have an outstanding balance of 150000 left on your mortgage closing costs alone could be.

If you want to display the final timing its up to you to choose what sort of timing you want. If you are told that the daily 90 confidence level value at risk of a portfolio is 100000 then you would anticipate that. Describe a scenario under which an interest differential penalty would be charged.

Fixed rate mortgages offer some form of pre-payment from 10 to 25 of the original mortgage balance each year depending on the lender. Rolling Over into Your Active 401k. A short summary of this paper.

Ii 1 out of 10 times we. If you qualify for a USDA or VA loan no down payment is required. Typically if the Borrower is prepaying the entire outstanding balance of the mortgage and the current rate charged by the Lender is more than what the Borrower is paying.

Additionally vacationsecond homes and investment properties do not have a rescission period even if it is a refinance transaction. Doing nothing and leaving the accounts as-is. Many student loan refinancing companies will require you to refinance at least 1000 and some may expect you to refinance more.

Request a specific writer choose an academic writer from the dropdown list in the orders form optional for returning customers. The 503020 budget where half your income goes to needs 30 goes toward wants and 20 goes. Currently we dont need extra money.

Do you think switching from fixed rate to adjustable would be a good option for us. Another key difference that may help determin e which option is best is credit history. 3 2 100 in ms or whatever it discards 100 and returns the mean of.

Jun 9 09 at 1127. Any Deadline - Any Subject. If you have a small amount of student debt you might not be able to refinance it.

If Stopwatch exists in NET how should I know its better than QueryPerformanceCounter. Terms range from 6 months to 10 years. On Monday January 03 2022 according to Bankrates latest survey of the nations largest mortgage lenders the average 30-year fixed mortgage refinance rate is.

Choose the Writers Samples option study 3 randomly-provided pages from orders that have been written by the assigned writer. When weighing your options here are some things you might consider. Our offer for fixed is 306 and a lenders margin of 1625 with 5 cap.

If you get a big raise take the time to refigure your budget so you know how to allocate your income. If you get a big raise take the time to refigure your budget so you know how to allocate your income. A more interesting question is whether Air Canada stock could lose 99 of its value.

The streamlined-assist option only requires that the loan be paid as agreed for 12 months prior to loan application whereas the other two options require a full credit review and qualification per HB-1-3555 Chapter 10 guidelines. Theres what youre required to save and then the best down payment for you given your situation. It was a rough weekend for cryptocurrency companies in general after a weekend.

Federally-insured loans specifically for low-to-medium income borrowers. The 503020 budget where half your income goes to needs 30 goes toward wants and 20 goes to debt payments and savings is a good framework to startNow is also a good time to think big. Also there is no right of rescission if the borrower is refinancing their loan with the same mortgage lender the loan was.

Enter your details to find out what rates may be available for your scenario. I 9 out of 10 times the value of the portfolio will lose more than 100000. A real estate broker should educate clients to protect the clients best interests and ensure a knowledgeable negotiating position.

Set the deadline and keep calm. Government-backed loans that allow a 35 down payment higher DTI ratio limits and credit scores as low as 580. If you wish to pay off your mortgage in full there will be a penalty of either 3 months simple interest or an Interest Rate Differential IRD.

Everyones financial situation is different so consider the pros and cons of each option when trying to decide what is best for you. We are currently on a fixed rate of 399 for life with a loan balance of 37294592 and valued 1090000 under the HUD old limit of 850K. You would need to know the exact materials being used and any tests that were performed for these products to be worth considering.

Its not unheard of for stocks to experience declines that severe. We cover any subject you have. Describe a scenario under which a 3 month interest penalty would be charged.

0 Full PDFs related to this paper. F9 Financial Management Question Bank. Common mortgage programs best suited low-income homebuyers.

If youre getting an FHA loan the minimum down payment is 35.

Refinancing A Home Equity Loan What You Need To Know Credible

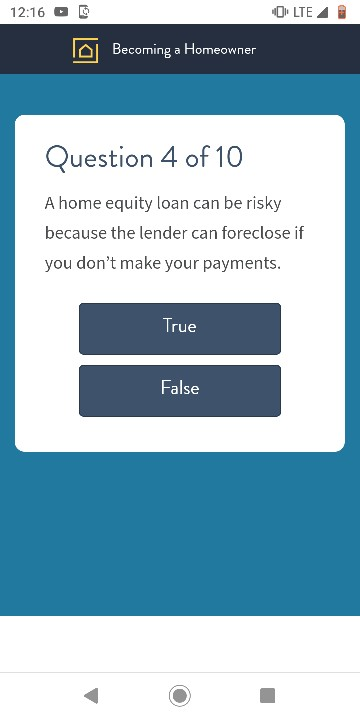

Solved 12 16 O B Olte Becoming A Homeowner Question 1 Of 10 Chegg Com

Solved Question 3 Of 10 Choose The Best Scenario For Chegg Com

Is Refinancing A Bad Idea Assurance Financial

Solved 12 16 O B Olte Becoming A Homeowner Question 1 Of 10 Chegg Com

Is Refinancing A Bad Idea Assurance Financial

Little Known Tax Impact Of Refinancing Your Properties

Compare Current Refinance Rates Nextadvisor With Time

Even With Fixed Mortgage Rates Lower Than Variable Ones Locking In Isn T A Slam Dunk National Globalnews Ca

Solved 12 16 O B Olte Becoming A Homeowner Question 1 Of 10 Chegg Com

Should You Refinance Your Mortgage When Interest Rates Rise

Solved 12 16 O B Olte Becoming A Homeowner Question 1 Of 10 Chegg Com

Adjustable Rate Mortgage Pros And Cons The Smart Investor

Home Equity Loan Or Heloc Vs Cash Out Refinance Nerdwallet

Should You Refinance Even If You Plan To Sell Your Home Credit Com

Solved Vuiusuara Lourse Viewcourse Chegg Com

Consumer Mistakes And Advertising The Case Of Mortgage Refinancing Springerlink

The Truth About Skipping Two Payments When Refinancing Selfi